Sep-2024 BPNG Monetary Policy Statement.

The Bank of PNG released its September Monetary Policy Statement (MPS) on the 7th October, setting out BPNG’s monetary policy stance for the next 6 months based on its analysis of the PNG economy. Here are our 5 takeaways from BPNG’s latest MPS:

- Non-mineral sector continues to drive growth this year

- Inflationary pressures are easing due to easing betelnut prices and tradable goods

- Waiting times for FX orders have trended down – which is a good thing!

- BPNG’s monetary tightening stance is being felt

- Monetary Policy is now under the authority of a new Committee (and not BPNG Board)

Non-mineral sector continues to drive growth

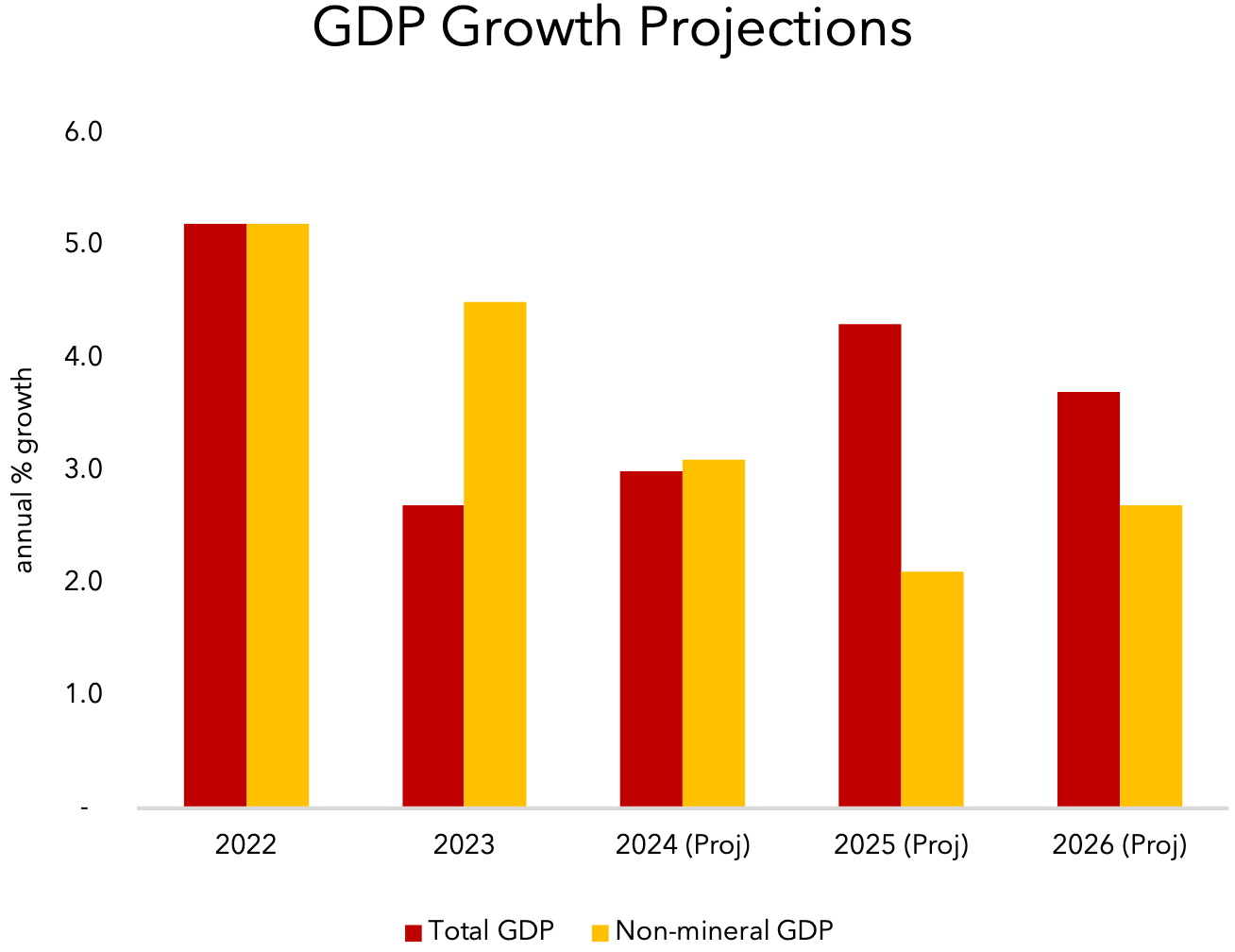

- BPNG forecasts overall Real GDP growth at 3% in 2024 (remains unchanged from its March statement).

- Non-mineral GDP growth was revised up from 2.1% (March) to 1%. Key drivers for higher non-mineral sector growth:

- Government spending;

- Construction activity; and

- High Cocoa and Coffee

- Downside Risks to this scenario include continued high global commodity prices due to on-going geopolitical conflicts (Russia/Ukraine and Middle-East).

- Upside Risk to growth outlook would be increased natural resource production due to higher Kina prices for commodity exports.

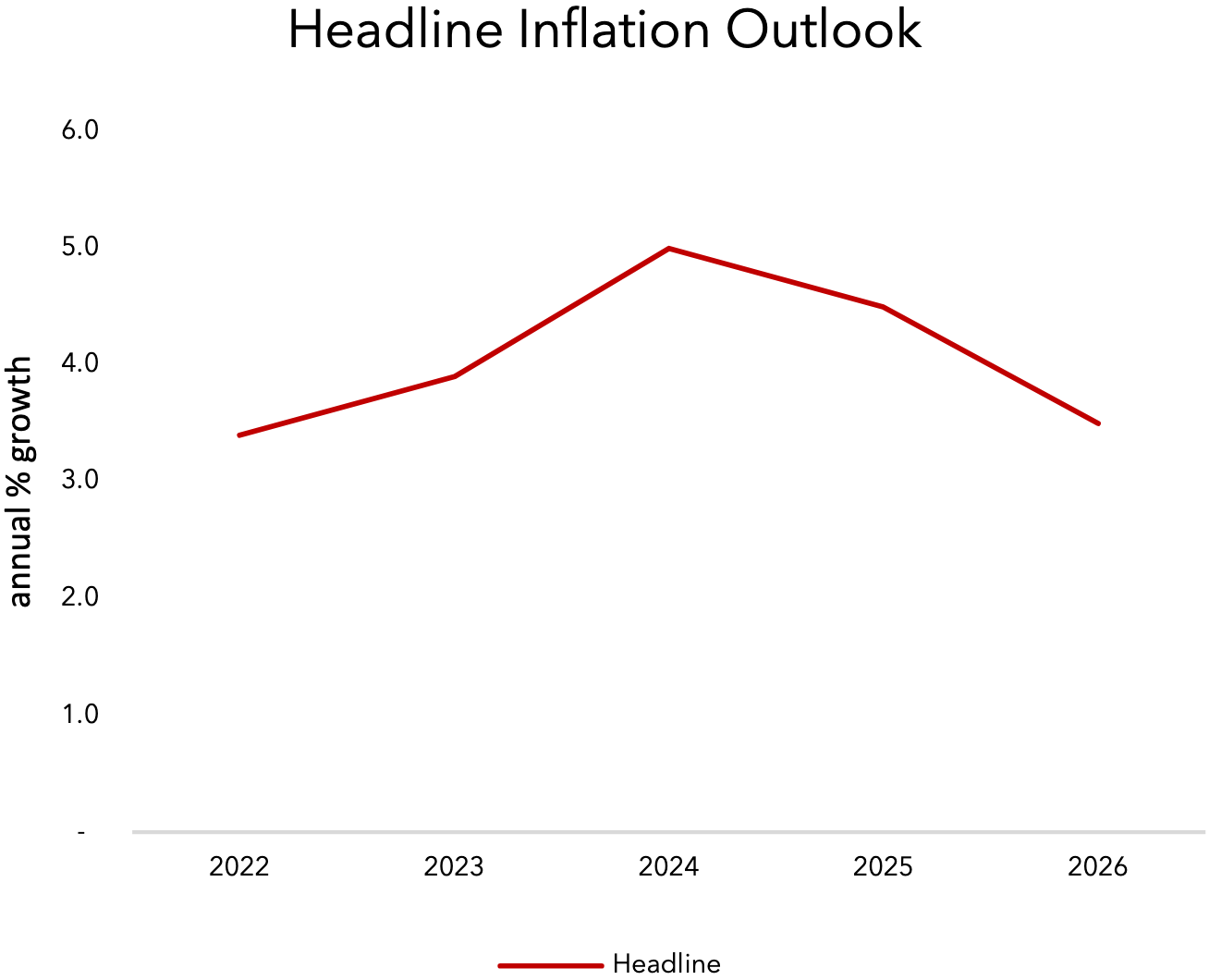

Inflationary pressures easing

- BPNG forecasts headline inflation of 5% in 2024, before easing off to 4.5% in 2025

- According to BPNG’s MPS, the slowdown in this year’s price increases has been attributed to betelnut and communication

- Imported inflationary effects have continued with the PGK depreciation, but at a slower pace during this past 6 months due to a fall in global energy prices.

- With the lower forecasts on the rate of inflation, it’s important to remember that inflation is a measure of the rate of change in prices during a particular period of time – it does not measure the price level.

BPNG will continue its FX intervention with US$125million a month

- BPNG will continue its support of the FX market through a ‘weekly auction process’ whereby dealers (commercial banks) are invited to ‘bid’ for the US BPNG has already intervened with US $1 billion into the market (January to August) at an average intervention amount of US$125million a month.

- According to the last 3 Monetary Policy Statements issued by BPNG over the past 12 months, waiting times for Import Orders to be cleared has been going BPNG’s approach to intervene on a more regular weekly basis providing the market with certainty and predictability.

| Monetary Policy | Order Book Value | Waiting Times | FX Intervention | Regularity |

| Sep’ 2023 | PGK 1.3 billion | > 8 weeks | US$100m/month | Monthly |

| Mar’ 2024 | PGK 1.3 billion | 6-8 weeks | US$125m/month | Weekly |

| Sep’ 2024 | PGK 1.0 billion | 4-5 weeks | US$125m/month | Weekly |

BPNG’s monetary policy tightening stance is being felt

- The BPNG’s decision to increase the Cash Reserve Requirement (CRR) from 10% to 12% within the space of 2 months (May – June) led to a series of chain reactions that has seen yields on Government securities (T-bills and GIS) increase since the June auctions to pre-COVID levels.

- Given there is an estimated PGK30billion in total deposits held with commercial banks, the “removal” of an extra 2% (increase in CRR) meant that circa PGK600million was placed with BPNG as cash reserve deposits and not utilized for customer lending or invested in Government We assume this “shortage of demand” for T-bills and GIS has contributed to under-subscriptions in recent Government auctions, leading to an acute spike in rates on Government securities. Furthermore, greater FX availability has possibly also lead to more PGK outflows – which would have otherwise been used for domestic Government securities.

- While the BPNG has utilized this CRR tool to “mop up some of the excess liquidity in the banking system”, it has also meant that banks have had to utilize BPNG’s repo facility to manage short-term liquidity requirements. So monetary tightening could be starting to raise retail interest rates.

New “Monetary Policy Committee” to take over monetary policy management

- The Parliament amended the Central Banking Act 2000 in September following a legislative review by an Independent Committee, with the amendments aimed at ‘modernizing’ BPNG’s governance arrangements. With these new amendments, PNG’s Monetary Policy management will now be the responsibility of a newly established ‘Monetary Policy Committee’ (MPC). Monetary policy oversight includes the setting of the Cash Reserve Requirement (CRR) for commercial banks, the Kina Facility Rate (KFR) and the exchange rate policy.

- This new arrangement shifts the responsibility of monetary policy decision-making from the current Board to a Committee of 5 members, including the Governor, the Deputy Governor, and 3 external Of these 3 external appointees, one must be a “non-resident expert in monetary policy”. This model appears to mirror that of the Independent Consumer & Competition Commission whereby an overseas ‘non-resident technical’ expert provides input into the Board’s decision-making process.

- The new amendments also require that each MPC must explain their reasons for making a decision on the Bank’s monetary policy stance. This legislated guideline is set to ensure that MPC members make decisions based on data presented with the primary objective of Central Bank in mind (price stability), whilst also ensuring the independence of monetary policy from fiscal policy.

Other considerations

International Reserves have been steady

- BPNG reported that foreign reserves are currently at US$3.4billion, compared to US$3.9billion at the start of the year. This represents 7.3 months of import cover, and 13.3 months of ‘non-mineral’ import So what does this mean, and is this good or bad?

- ‘Months of Import cover’ is used to measure a country’s balance of payments position and its ability to absorb external As a commodity exporting country with revenues dependent on global prices, PNG’s balance of payments management is contingent on ensuring its foreign reserves are sufficient to ‘cover imports’. This metric is simply calculated by dividing total foreign reserves by total value of imports and multiplying this by 12 (months).

- However, because most resource companies in PNG hold their earnings off shore to meet their foreign currency commitments, BPNG adjusts this ‘import cover’ metric to only measure the “value of goods imported for the non-mineral sector”, rather than all imports. When adjusting for only ‘non-mineral’ imports, this is currently reported at 13.3 months of import cover – which is above the 3 months threshold which would be a cause for concern.

There will be a commercial bank license issued in 2025

- BPNG announced in the statement that there will be a new commercial bank license issued in TISA Bank and Credit Bank started operations in Q3 this year. Details of the next entrant into the market are yet to be revealed.

- Increased competition is good news for However, the challenges of operating a commercial bank will still exist. A major concern is securing a Correspondent Banking Relationship (CBR) overseas to facilitate FX transactions. It will be much more difficult to establish a CBR relationship for new PNG banks given the current state of the AML/CTF regime being reviewed by the Financial Action Taskforce (FATF), which could potentially lead to PNG being “grey-listed” if certain conditions are not met. Furthermore, the Government’s continued stance on a 45% commercial bank tax will be a drag on financial sector growth.

Treasury is very quiet on the State of the Economy

- Given the lack of recent commentary from the Government on its current fiscal position, the MPS provides the business community with some insights on the state of the economy as analyzed through official statistics managed by Government The Treasurer is yet to announce the Mid-Year Economic Fiscal Outlook (MYEFO) which was initially due for release at the end of August.

- Another observation has been the independence of the monetary policy settings to absorb excess liquidity, which has (inadvertently) raised the Government’s borrowing costs to fund its fiscal Since there has been no MYEFO release, or a Supplementary Budget for that matter, it will be interesting how fiscal policy settings are managed heading into the final quarter of 2024.